How we can help

We have one of the largest and most experienced teams of will, estate and tax planning lawyers in Kent and the South East, which has been trusted by generations of families. We work with you to protect your assets and pass on your wealth to the next generation in the way that best suits your circumstances.

Our estate and tax planning lawyers have extensive experience of supporting high and ultra-high net worth individuals and families with complex asset structures and international elements. We can help you to plan for the future and minimise your tax liabilities, for example through the use of trusts and other appropriate structures.

Working with us, you will benefit from the support and collective experience of the whole firm. We offer a strong network of lawyers to provide a comprehensive service, including probate, trust management, tax compliance, family law, The Court of Protection and buying or selling a home.

Accreditations & awards

Accreditations & awards

Thomson Snell & Passmore are known as a very solid, reliable Private Client practice in the South East. Having multiple offices means they can cover a substantial client base geographically. They are also a very modern firm by comparison with some of their direct peers, investing in technology and innovation to stay ahead of the curve.

Making a will & estate planning

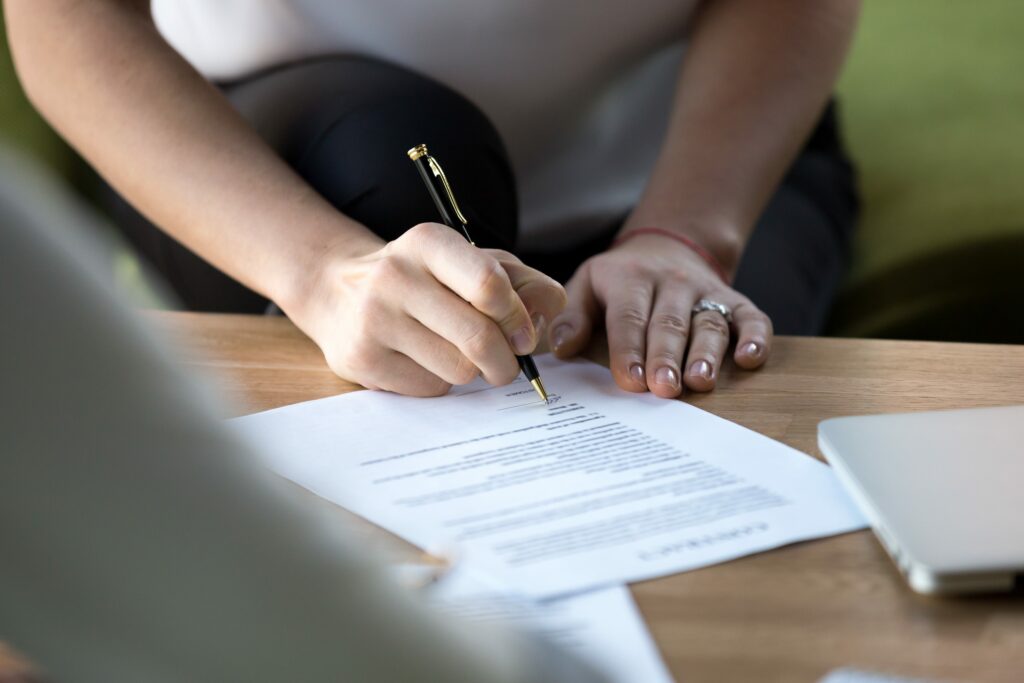

It is only natural to wish to pass on your wealth to benefit your loved ones or create a lasting legacy by giving to charity. The truth is that you are never too young to think about what will happen to your family – especially your children – and your assets when you pass away. In fact, your will is arguably one of the most important documents you will ever sign.

Our team of will, estate and tax planning lawyers in the South East has been trusted to deliver peace of mind to generations of families. We pride ourselves on building long lasting relationships with our clients, developing a deep understanding of their individual needs, and tailoring our services accordingly.

What should you include in your will?

If you do not yet have a will in place, the key elements to consider include:

- Wishes for your funeral

- Appointing executors

- Appointing guardians to look after your minor children

- Making gifts of cash or personal possessions, as well as gifting to charity

- Providing for a spouse or partner – if you live with someone, but are not married or in a civil partnership, your partner will have no automatic rights to your property if you die. There is no such thing as a ‘common law’ husband or wife. Spouse and civil partners also benefit from spouse exemption for Inheritance Tax purposes but unmarried partners do not

- Providing for children, especially in terms of whether to pass assets to them outright or whether to hold assets in trust for them

- Determining all of your assets and liabilities, i.e. property, bank accounts, stocks and shares, pensions and life insurance, digital assets, mortgages and other debts

- International assets and how they will pass on your death, bearing in mind that taxation and succession rules in other countries can be very different from the rules in this country

- Business interests, shareholdings and agricultural assets, including the tax reliefs that can apply to these assets and how to maximise or safeguard those reliefs.

When should you update your will?

For those who already have a will in place, it is sensible to review it on a regular basis, and especially in light of any of the following:

- Marriage or civil partnership – getting married or entering into a civil partnership will revoke any will you have in place already, unless the will makes specific provision for the marriage

- Divorce

- Changes to executors

- Changes to beneficiaries – this is especially true if you make a will and subsequently have children

- Acquiring or selling property or assets – ideally advice should be sought before the sale or purchase goes ahead

- Inheriting assets.

Thanks for your help, support and guidance with regard to our wills, you certainly made it very easy and your advice to our specific queries were expertly dealt with.

What happens if you die without a will?

Many people do not realise that if they die without having made a will, strict intestacy rules apply, which may mean your assets do not pass on as you would like them to. These rules may also cause tax problems for those you leave behind.

What is the difference between making a will and wider estate planning?

An estate plan is a broader plan of action for your assets that may apply during your life as well as after your death.

For many people with relatively straightforward assets and circumstances, a simple will should suffice. However, if you have more complex circumstances such as international assets or business assets, or if you wish to take advice on tax planning or setting up trusts, then an estate plan is recommended.

What should be included in an estate plan?

Estate planning might include:

- The preparation of your will(s) including a review of your Inheritance Tax position, any associated trusts, rights of occupation, and letters of wishes

- Advice on joint property ownership or the right to reside in property

- Inheritance Tax mitigation advice, including allowances and exemptions and, where relevant, lifetime gift planning and the use of trusts or companies for asset protection and tax planning

- Business protection and succession planning, and Inheritance Tax advice on agricultural and business assets

- Advice on death-in-service benefits and life policies

- Advice on potential claims against your estate or your capacity to make a will

- Advice on domicile issues affecting the drafting of your will(s) and general advice on issues relating to foreign property

- Advice on charitable donations

- Advice on creating Lasting Powers of Attorney

- Advice on planning for potential care home fees.

How can I make sure my will isn’t challenged?

In England & Wales, we have something called “testamentary freedom”, which means it’s up to each individual how they decide to leave their assets when they die. This is in contrast to some other countries or legal systems, which have forced heirship provisions that can apply to all or part of an estate. But the press is full of stories about wills being challenged, or claims being made against estates. That type of claim is definitely on the increase, and there are a number of grounds on which a will can be challenged. So what can you do to make a challenge less likely?

The first thing is to be aware of the grounds on which a will can be challenged – some of those are practical, others more complicated. A will can be challenged if it hasn’t been signed and witnessed properly. That is why we send careful instructions on how to sign your will if you can’t come into the office. It might be challenged if somebody feels that undue influence was exercised over the person making the will: that could be by a family member, friend or a carer. Another possible reason for challenge is the mental capacity of the person making the will: they need to understand what they are doing, the extent and nature of their assets, the persons for whom they should consider making provision, and be able to make decisions and hold that information in their mind. The ability to do so can be affected by illness, medication, recent bereavement or other factors. If there is a risk of a challenge on those grounds, your solicitor might suggest an independent report on your capacity to make a will, to reduce the risk of a successful challenge.

Another basis for challenge is where somebody feels that the person making the will should have provided for them, but either hasn’t, or has made provision that the potential claimant feels is too low. This could lead to a claim under the Inheritance (Provision for Family and Dependants) Act 1975. Finally, once you have made a will you should review it regularly to ensure that it still represents your wishes accurately, and provides for the correct beneficiaries.

It isn’t possible to prevent a challenge to your will, but there are definitely steps you can take to reduce the risk of a successful challenge. Our expert lawyers have experience in helping to prevent challenges, but also in managing a challenge if it does arise.

Accreditations & awards

Minimising your exposure to Inheritance Tax (IHT)

Once seen as a tax exclusively on the super wealthy, the Inheritance Tax (IHT) net is creeping ever wider, partly due to rising property prices.

Currently, IHT is paid at 40% on the value of an estate over the Nil Rate Band (NRB), which since 2009 has been set at £325,000 for an individual and £650,000 for a couple. This amount can be reduced by certain gifts and transfers during lifetime. There is also a Residence Nil-Rate Band (RNRB), which means if you are leaving your main home to children or grandchildren and your estate is worth under £2 million, you (and your spouse) can benefit from an additional £175,000 allowance each.

These thresholds have been frozen until 2028, which means even more estates will potentially be impacted by IHT.

Our Inheritance Tax experts have extensive experience of working with individuals and families to help them significantly reduce their exposure to IHT. The key is to plan ahead.

How can I reduce Inheritance Tax (IHT)?

There are a number of key ways to reduce your IHT liability. These include:

- Making use of exemptions

- Gifting assets

- Charitable giving

- Setting up a trust or family investment company

- Ensuring your will is tax efficient

- Other measures such as nominating a trust to receive your death-in-service benefits from your employer, placing your life policy into trust or making use of deeds of variation in relation to inheritances.

The very personable Nicola Brant is experienced in all aspects of private client work. She assists clients with estate administration, estate planning and Inheritance Tax and Capital Gains Tax planning.

What are the rules on gifting assets to reduce Inheritance Tax (IHT)?

An outright gift is one of the simplest ways to reduce an estate, for example, by giving an adult child or grandchild a deposit for a house, or helping to pay for school fees or university tuition fees. Such gifts are Potentially Exempt Transfers (known as PETs) and are taken into account for IHT purposes if you die within seven years of the gift. This is known as the ‘seven year rule’.

Some gifts are completely left out of the IHT calculations, and are not subject to the seven year rule. You can give away £3,000 a year and can roll forward one year’s allowance if it was not used the previous year. You can also give up to £250 to an unlimited number of people each year. It is also possible to make regular gifts out of surplus income, which are immediately exempt from IHT, though it is important to keep meticulous records of these.

Any money passing to a registered UK charity, whether through a lifetime gift or as an inheritance, is exempt from IHT. Broadly speaking, if your will leaves 10% of your estate to charity then a lower IHT rate of 36% (rather than the usual 40%) applies to the balance of your estate. There are complex rules around this so it is important to take specialist advice.

Charities can also benefit under a post death variation. Even if no gift to charity is made in the deceased’s will, the beneficiaries of the estate may posthumously be able to redirect some of their inheritance to charity in this way. The beneficiaries have a two year window starting with the date of death in which to carry out a variation. Any such variation to charity will benefit from charity exemption for IHT purposes.

Do you pay Inheritance Tax (IHT) on business or agricultural assets?

There are a range of very significant reliefs from IHT for business assets, including Business Relief (BR) and Agricultural Relief (AR). The latter is specifically for agricultural businesses and land.

Where there is a farming business, and where both types of relief may need to be applied, AR is applied first. These reliefs can help save a substantial amount of IHT, and potentially avoid the need for the farm or business to be sold.

The rules around BR and AR are complex, so advice should be sought early, but they have the potential to offer 100% exemption from IHT for business or agricultural assets.

Creating a trust or family investment company

Trusts and family investment companies can potentially be beneficial for Inheritance Tax planning, asset protection and wealth accumulation.

We have extensive experience in setting up and managing a wide range of trusts including:

- Discretionary trusts

- Life interest trusts

- Bare trusts

- Charitable trusts

- Insurance trusts

- Personal injury trusts

- Will trusts.

A Family Investment Company (FIC) is a bespoke private company, which can be used as a tax-efficient alternative to family trusts. A FIC is a flexible structure, allowing families to define how specific family members benefit through varying rights attaching to shares, or the number of shares in issue. The directors and shareholders of the FIC are normally family members. As with trusts, the structure of the FIC can enable parents/grandparents to retain control over assets, whilst accumulating wealth in a tax-efficient environment and facilitating future succession planning. It is preferable to set up FICs with cash (usually by loan), as the transfer of property or shares could create capital gains tax and stamp duty liabilities.

We also have an expert Trust & Tax Management team, who can assist with everything related to managing trusts.

How can Family Investment Companies (FICs) help reduce Inheritance Tax?

A FIC can help families manage their exposure to Inheritance Tax (IHT) in several ways. The key features and benefits of a FIC are as follows:

- When the FIC is formed, shares can be given to family members without incurring any immediate tax charges and, after seven years, the full value of what has been given away will pass out of the estate of the founders, so avoiding any IHT

- If the founders lend initial capital to the FIC, any growth in the value of investments held by the FIC will be outside the founders’ estates

- The founders can create distinct classes of shares, so enabling them to decide which of those share classes (including those retained by the founders) receive the dividend income declared by the company (and the capital if the company is ever wound up)

- If shareholders have a minority interest in the FIC, the value of their shareholding will be discounted on death for IHT purposes, taking into account the size of their holding and their inability to sell the shares or demand income from the company

- Unlike trusts, the FIC will not pay periodic charges to IHT which apply to trusts at up to 6% every ten years, or exit charges if and when capital is distributed although there are other tax charges that may apply

- A FIC may provide useful protection in the event of a shareholder’s divorce. The FIC can be structured so that shares can only be held by direct family members (excluding spouses).

What is the difference between a trust and a family investment company (FIC)?

Trusts and FICs are alternative structures for holding family wealth and both can be used for IHT and estate planning purposes. Usually, FICs are set up with cash rather than specific investments to avoid tax charges arising at the point the assets are transferred into the FIC, whereas trusts can potentially receive a much wider range of assets when they are set up. Both trusts and FICs are subject to their own tax regimes and careful thought needs to be given in terms of which would be the appropriate structure in any given set of circumstances.

How can trusts help to reduce Inheritance Tax (IHT)?

Placing assets in a trust can mean they are no longer considered part of your estate when it comes to IHT. If you create a trust by a variation within two years of an inheritance received after someone’s death, you can potentially still control the assets and receive an income from them without the assets forming part of your estate on your death. Trusts are also a good option if you want to give away money or assets to family members, but would still like to retain some control.

Using deeds of variation to redirect an inheritance is an under-used but very effective way to reduce future IHT if your estate is likely to be subject to IHT.

Nominating a trust to receive death-in-service benefits from an employer or placing life insurance policies into trust can avoid inflating a spouse, civil partner or partner’s estate for IHT purposes, but the funds remain fully available to them should they be needed.

What are the different types of trust?

There are a number of different types of trusts that can be created either during your lifetime or on your death, and the key types are as follows:

- Discretionary trusts are where the trustees hold the trust assets at their discretion, so that the beneficiaries named in the trust do not have any specific rights to either the capital or income. These sorts of trusts are often used for estate protection purposes as a result

- Life interest trusts are where one or more beneficiaries have a right to receive the income generated by the trust, but do not have any rights to the trust assets themselves

- Bare trusts are where the underlying beneficiaries are absolutely entitled to the assets held within the trust, and the trustees act as the legal owners of the assets, usually until the beneficiaries reach the age of 18, but they continue beyond then in some circumstances

- Charitable trusts are run exclusively for charitable purposes

- Pilot trusts are usually set up on a discretionary basis but with no assets in them at the outset so that they can later receive payments from life policies, death in-service benefits and other similar benefits, usually on death

- Personal injury trusts are designed to hold the damages that arise from personal injury claims, and the trustees will then manage and invest those funds on behalf of the beneficiary to whom the damages were awarded

- Vulnerable person’s trusts are created to hold assets for individuals who are treated as being “vulnerable” within the legal definition, and are designed to manage those assets for the vulnerable beneficiary

- A ‘will trust’ is a generic term relating to any trust that is created in a will when someone dies, and the type of trust or trusts involved can be one or more of the varieties referred to above.

All these trusts have tax and other considerations on creation and during the lifetime of the trust. Before creating any kind of trust, it is essential to take advice on the type of trust involved and the tax and other implications of the trust being created.

What are the benefits of setting up a trust?

Setting up a trust can have a variety of different benefits. Many trusts are created through wills and come into effect when the person who has made the will dies. These sorts of trusts are typically designed either to mitigate Inheritance Tax (IHT) (usually because the person owned business or agricultural assets to which certain inheritance tax reliefs apply) or to protect the deceased person’s estate for the benefit of their children or other nominated beneficiaries. A trust will keep the assets out of the estate of those beneficiaries, which can be useful as a way of guarding against a beneficiary divorcing, going bankrupt, experiencing other financial difficulties, exceeding asset limits for care funding purposes or for longer term IHT planning.

Lifetime trusts can also be set up to mitigate IHT, especially where life policy proceeds or death in-service benefits are added to those trusts. Alternatively, it is possible to create a trust and then to transfer assets into it to take advantage of the lifetime gifting rules. This usually means that the donor of the gift needs to survive seven years in order for the gift to fall out of account for IHT purposes. Creating a lifetime trust can give rise to a tax liability under some circumstances so it is a good idea to take advice first.

Can a trust protect assets in the event of divorce?

Many parents are concerned about the possibility of their children divorcing and whether this would allow their child’s former spouse to make a claim against assets inherited from the parents’ estates. If the parents create wills leaving their estate in trust on their deaths, this can help to protect their estates. The trust means that the inheritance does not belong to the child outright and is therefore much better protected in the event of a divorce. At some later point, the trust can be wound up and the assets distributed to the child when it is safe to do so.

Very proactive. Very quick turnaround. High level of attention to detail.

Creating Lasting Powers of Attorney

We all hope to go on running our lives for as long as possible, but need to plan ahead for a time when we may need help in making decisions.

Our experienced and friendly lawyers have extensive experience in helping people to put Lasting Powers of Attorney in place.

What is a Lasting Power of Attorney?

A Lasting Power of Attorney (LPA) is a legal document in which you appoint one or more people (the attorneys) to act on your behalf, in circumstances where you no longer have capacity to make decisions yourself. You can decide who you appoint, what powers they have and specify any wishes you want followed.

Having an LPA in place can avoid the expense and the potential difficulties of a Court of Protection Deputyship application if you later need someone to act on your behalf.

I was given what I believe to be good and concise advice concerning the two areas I had requested. Simon was able to explain issues clearly which I could understand and therefore complete the necessary forms correctly.

What are the different types of Lasting Powers of Attorney?

There are two types of LPA:

- Property and financial affairs

- Health and welfare.

Under a property and financial affairs LPA, your attorneys can make decisions on your behalf such as buying and selling property, opening and closing bank accounts, dealing with your investments, managing your day to day finances, and claiming benefits and pensions. This type of LPA can be used at any time after registration, even if you still have capacity. In those circumstances, it should be used by your attorneys with your consent.

A health and welfare LPA can only be used if you have lost capacity to make health and welfare related decisions. It enables your attorneys to make decisions about where you should live, the type of care you receive and day-to-matters such as your daily routine, diet, visitors and the social activities which you participate in. If social services are involved in decisions about where you may live and your care in the future, then it can be particularly helpful to have an attorney who is authorised to make decisions of this type for you. Your attorney can also give consent to or refuse medical treatment on your behalf if you give them this specific authority. This could include making a decision as to whether or not you receive life-sustaining treatment in certain circumstances, giving you peace of mind that someone you trust and who is aware of your wishes is acting on your behalf. If you choose not to give your health and welfare attorney this particular authority then decisions about life-sustaining treatment would be made by the doctors and other professionals overseeing your care at the time, and any decision made would need to be assessed to be in your best interests and subject to any Advance Decision you may have made.

You can create either or both types of LPA. Ensuring an LPA is in place will mean that decisions can be made quickly and by someone you trust if you ever lose capacity.

How do you go about putting a Lasting Power of Attorney in place?

An LPA is an extremely important document and requires careful preparation and sound legal advice. Download our complete Lasting Powers of Attorney pack containing comprehensive information and the relevant forms.

Who can be appointed as an attorney?

You can appoint a friend, a relative or a solicitor as your attorney and they must be over 18. As with deputyships, our trust corporation, the Thomson Snell & Passmore Trust Corporation, can act as a professional attorney for property and financial affairs LPAs.

How many attorneys can I appoint?

You need to appoint at least one attorney and if you choose more than one, you will need to decide whether you want your attorneys always to act together (a joint appointment) or whether they can also act separately (a joint and several appointment). A joint and several appointment is the most flexible option. You can also choose to appoint a replacement attorney if your first choice is unable to act for any reason.

What are an attorneys’ duties?

Your attorney has formal legal duties and must follow the principles set out in the Mental Capacity Act 2005 and the Code of Practice. Your attorney must act in your best interests and take account of your wishes, feeling and beliefs.

You can apply conditions and restrictions on the use of the LPA and can also include guidance as to how you would expect your attorney to act.

Making a post death deed of variation

Making a post death deed of variation

If you benefit from a deceased person’s estate under a will or intestacy, or as the surviving owner of a joint asset, you may wish to redirect the inheritance to others. There are considerable tax advantages if this type of gift is made by a qualifying deed of variation.

Can a will be changed after death?

Any beneficiary who inherits under someone’s will or the intestacy rules (if the deceased person dies without a will) can vary their inheritance. The document which deals with this is known as a deed of variation and must be signed within two years of the date of death in order to be valid. A variation can deal with some or all of the beneficiary’s inheritance (so they can vary all of it or perhaps vary some of the inheritance and keep the rest), and the inheritance which is varied can pass to other individuals outright, or into trust. If assets are varied into a trust, this can often be part of an exercise in wider estate planning as the trust assets are then outside of the estate of any individual person. This can be particularly useful for the beneficiary who carries out the variation, as they can still benefit from the trust in a way that keeps the trust assets out of their estate for inheritance tax purposes when that beneficiary dies.

Highly professional. Patient and client focussed advice. Helped to consider the matter objectively.

What is a deed of variation?

A deed of variation is an under-used but very inheritance tax effective measure. It is used when a beneficiary inherits from an estate, but wishes to remove that inheritance from their own estate to avoid a future inheritance tax liability on their own death. If a deed of variation is used to create a trust, the beneficiary will potentially still be able to benefit from the inheritance going forward.

What are the advantages of a deed of variation?

A deed of variation which satisfies the relevant conditions will not trigger a tax liability for the original beneficiary. Instead, for all inheritance tax purposes (and in important capital gains tax respects) the gift effected by the deed will be treated as if made by the deceased if it contains the appropriate tax statement.

This enables tax exemptions to be claimed retrospectively, and can prevent assets from forming part of the beneficiary’s chargeable estate.

Deeds of variation also provide unique opportunities for trust creation without the usual limitations imposed by ‘reservation of benefit’ rules or ‘pre-owned assets’ income tax. So they should definitely be considered by those who have received an inheritance from which they may wish to benefit, but who also want to reduce their estate’s tax exposure.

Can deeds of variation be used on property?

Deeds of variation can be used for any assets which are inherited by a beneficiary. Very often, the assets in an estate are sold as part of the administration process but if the beneficiary wants to keep a specific asset such as a property, and transfer it into trust through a variation, then the beneficiary is free to structure the variation in this way.